(800) 435-4765

Mon - Fri 9:00am - 5:00pm

Are you planning for retirement? An annuity is an option that may allow you to benefit from guaranteed monthly payments during retirement. Common types of retirement annuity plans include 401Ks, IRAs, and TSAs, although others certainly exist as well. In today’s blog post, we are going to discuss what an annuity is, how it works, and how it may be able to help you save for retirement.

Continue reading to learn more, and if you are interested in speaking to a helpful, knowledgeable agent about annuities, it’s time to schedule a consultation with Medi-Solutions Insurance Agency, LLC. Contact us today to learn more.

An annuity is commonly used as a retirement vehicle for those who are looking for a solution that can provide them with a guaranteed monthly source of income for life. While this is not the only possible use of an annuity, for the purposes of this article, we will be focusing on utilizing an annuity for retirement purposes.

Annuities are unique in that the funds grow on a tax-deferred basis. Depending on the type of annuity you purchase, you may be required to pay taxes as the money is paid out. However, if you purchased the annuity as a part of a qualified retirement program such as an IRA or 401K, this may differ depending on the terms of your policy and whether you have met certain criteria.

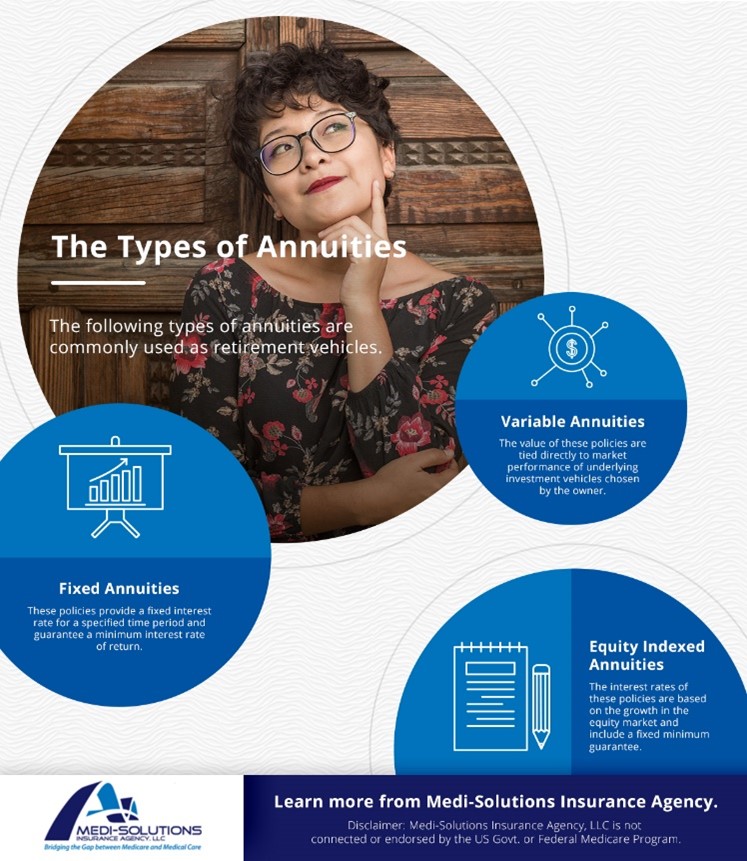

There are several different types of annuities, so it’s essential that you speak to someone who is experienced in the world of annuities and retirement investments like the helpful insurance agents at Medi-Solutions Insurance Agency, LLC. Our team is standing by to help explain your options for annuities so that you can make an informed decision on setting up your retirement policy.

Annuities have two phases: the accumulation phase and the distribution phase.

The accumulation phase is essentially what it sounds like; it is the time period where the funds in your annuity grow on a tax deferred basis. Your annuity will fall under one of two payment modes:

Annuities can also vary by the timing of when your annuity income begins. Each annuity will fall into one of the following two categories:

Attempting to withdraw your money from your annuity before the age of 59 ½ can result in a penalty called premature distribution. Policies may also be subjected to surrender charges for early withdrawal. Although some policies do allow for partial withdrawals without these fees.

When the accumulation phase is complete, an annuity moves into the distribution phase where the owner can withdraw their money or purchase an annuity payout plan. In an annuity payout plan, the owner of the policy will receive monthly payments for at least the remainder of their life. Although there are several payout plans that can be chosen:

If you are considering an annuity as a retirement vehicle, it’s time to speak to an experienced agent at Medi-Solutions Insurance Agency, LLC. Our team is dedicated to ensuring that each one of our customers has the information they need to make an educated decision about their retirement plans. Contact us today to schedule a consultation.

Information is for educational purposes only and should not be construed as an offer of insurance, advice, or recommendation. The information provided is not intended as tax, financial, investment or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Not connected or endorsed by the US Govt or the Federal Medicare Program. Medi-Solutions Insurance Agency, LLC is an independent Life, Accident and Health Insurance Agency, NJ Ref#1642311. Some plans and features may not be available in all states.

Other articles:

Learning Center.