(800) 435-4765

Mon - Fri 9:00am - 5:00pm

Planning for your family member's financial well-being when you pass away is both a necessity and a challenge. There are several things to consider, such as what kind of protection you can afford, what kind of debts you may have when you die, and how much money your family will need to live when you are no longer around.

One of the best ways to protect your loved ones is through a life insurance policy. There is a lot to know before deciding which policy is best for your situation. Here's what you need to know before you start shopping.

First things first. A life insurance policy is a contract between you and a life insurance company that guarantees the company will pay your beneficiaries a predetermined sum of money if you pass away. In exchange, you agree to pay premiums to keep the policy in force for either an agreed upon amount of time or for the rest of your life.

The exact benefits your beneficiaries receive depends on the type, amount, and duration of the policy you purchase. However, in general, here are some compelling reasons why life insurance is a good purchase:

There are many situations and circumstances that dictate the need for life insurance coverage. When thinking about your life insurance needs, a good general rule to consider is that if you would leave a loved one with a financial burden in the event of your death, then life insurance is necessary.

Here are some examples of people who may need life insurance:

The two major categories of life insurance are a term life insurance policy and a permanent life insurance policy. Let's take a closer look at each type.

Term Life Insurance

As the name suggests, term life insurance lasts for a predetermined number of years and then the policy ends. Typically, policies are offered in a 10-, 20- or 30-year period of time, but other lengths are available. When your original term ends, you may have the option to renew your life insurance plan, but your rates can change based on your health, age, lifestyle, and other factors.

Term life insurance is offered in several ways. The most common policies include:

Permanent Life Insurance

This type of policy stays in force for the insured person's entire life if premium payments are paid and the policy is not surrendered. It is more expensive than term life. Forms of permanent life include:

Deciding which type of policy to buy requires analyzing your current and future financial situation, including how much money would be required to maintain your beneficiaries' standard of living or meet the need for which you're purchasing a policy.

Common life insurance payout options include:

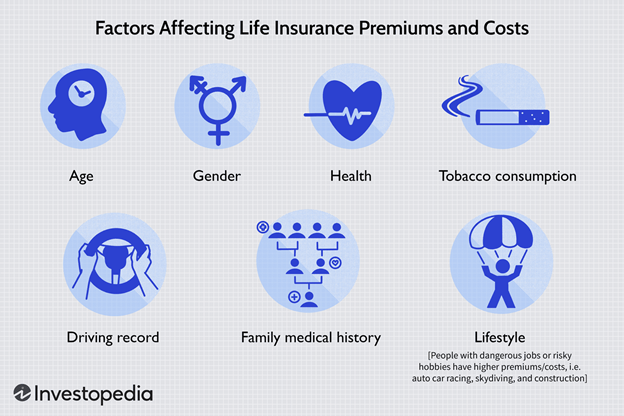

All these factors can influence how much life insurance to buy. Any of the above can add to your risk profile. In turn, your premiums will be higher.

Life insurance providers typically do not offer discounts, unlike home or auto insurance. However, there are still ways to get a lower rate. Aside from the other benefits, you'll pay less if you can demonstrate that you've improved your health by not smoking, maintaining a healthy weight, you exercise regularly, and you are managing existing conditions with your doctor.

If you think you're paying too much, you're always free to comparison shop for a different policy with other providers.

First, you'll want to determine your purpose for signing up for a life insurance policy. Are you choosing to get life insurance to ensure that your spouse can afford the mortgage after your death? Do you have dependents? How much debt do you currently have? All of these and more should be considered to determine the amount of life insurance you should get.

While it is sometimes suggested that you calculate your needed death benefit amount by multiplying your yearly income by five to seven times, this suggestion is not a substitute for proper planning. If you are considering signing up for life insurance, you should take the time to plan accordingly.

Once you've determined the type of policy and the amount you need, we suggest getting life insurance quotes from several companies, which Medi-Solutions can help you with.

After you have reviewed quotes and selected which company you want, you will complete that company's application process. Many of the largest life insurance companies offer an online or phone application process for your convenience. You may be asked to get a medical exam to assess your general health or complete a health questionnaire as part of the application process. Like any other process, you'll also need to provide certain basic facts about yourself, so make sure to have the following available:

You will be asked to give the insurance company permission to access medical and financial records to verify your information, such as an Attending Physician Statement from your doctor. There may be a follow-up phone call from the insurance company to check that your details are correct and get answers to any remaining questions.

After your application is approved, you have agreed on a premium, and you are satisfied that you understand your policy and agree to the terms, sign two copies and mail one back to the insurer. You will pay the premium, and your coverage will take effect.

Remember that the time between applying for life insurance and when your coverage starts is typically a few weeks. Be sure to keep a copy of your policy in a safe place and let your beneficiaries know where it is.

It is possible to purchase life insurance with some types of preexisting conditions. A preexisting condition is a medical issue you were diagnosed with or treated for before applying for life insurance.

There are a few things to know if you're in this situation.

First, the ability to buy a policy depends on the conditions you suffer from. If you have diabetes, asthma, HIV, obesity, or other similar manageable conditions, you can likely purchase coverage. The catch is that you'll pay a higher premium due to the increased risk. But if you have a terminal illness, such as cancer, ALS, muscular dystrophy, or other catastrophic illnesses, it will be harder—but not impossible—to find an insurance company to approve coverage.

Each insurer will have its own preexisting condition criteria, so do your homework to find a company that will work with you based on your medical situation.

If you have a preexisting condition, one option is to purchase a guaranteed issue life insurance policy. With this type of policy, no medical exam is required. You're guaranteed acceptance if you're within a certain age range. Also, payouts don't involve a large amount of money, as many of these policies cap death benefits at around $25,000. This type of life insurance also often has a graded benefit, which means the insurer won't pay out if you die within a few years of buying the policy.

Whatever else you do, never lie on your policy application. Life insurance companies ask questions about your health, and the process typically requires you to give the insurer permission to access any medical records needed to validate your information. If you don't buy a guaranteed issue policy, you will be required to undergo a medical exam as part of the underwriting process, and they will look for specific markers in your blood work and other tests that indicate an underlying medical condition.

If you commit fraud and it's discovered later, an insurer could reject future claims. Also, if the insurer finds fraudulent information, it may record the fraud in the Medical Information Bureau database, which is shared with other insurers, thus hurting your chances of buying coverage from another company.

DISCLAIMER: Medi-Solutions Insurance Agency, LLC is not affiliated or endorsed with the Social Security Administration or the Federal Medicare Program. Information is for educational purposes only and should not be construed as an offer of insurance, advice, or recommendation. The information provided is not intended as tax, financial, investment, or legal advice. Please consult legal or tax professionals for specific information regarding your situation.

Other articles:

Learning Center.