(800) 435-4765

Mon - Fri 9:00am - 5:00pm

Many people are already aware of what Medicare is and how it works. If you fall into that category, then skip ahead to the next section.

However, if you don't understand the basics of Medicare, here's a high-level overview of how it works.

Medicare is a federal health insurance program administered by the Centers for Medicare & Medicaid Services. People 65 and older and some younger people with qualifying disabilities such as End-Stage Renal Disease and ALS are eligible for benefits.

Medicare has four parts:

There are no premium costs for Part A in most cases, but you will be responsible for paying deductibles and copayments as services are rendered. You'll have to pay a monthly premium for all other parts of Medicare.

Like other insurance plans, there are maximum benefits, exclusions, and other requirements. You pay monthly premiums and are sometimes responsible for out-of-pocket deductibles and copayments.

Medicare supplement plans are also known as Medigap plans. Medigap is private health insurance consumers can buy to help pay healthcare costs not covered by Medicare.

Medigap plans are not Medicare Advantage plans (Medicare Part C). They are entirely different.

Various types of Medigap plans cover different costs and services. To help distinguish plans, they are lettered from A to N (not all letters are used). However, they are standardized from state to state, meaning that if you buy a Medigap A policy in New Jersey, it will be the same as in all other states and the same for each provider in each state.

Medigap is private health insurance designed to help pay healthcare costs that Medicare doesn't cover. Each Medigap plan covers different costs and services.

NOTE: Medicare-eligible employees and retirees may get group coverage to supplement their Medicare from their current or former employer. This coverage may offer more comprehensive benefits at a cheaper rate than publicly offered standardized Medigap individual plans. Check with your employer to see if this is the case.

Medigap policies are optional coverage you can buy that helps you fill in the "gaps" that your Medicare coverage does not provide.

Policies are issued to individuals only. This means if you want coverage for both you and your spouse, you'll need to buy two separate policies.

Medigap policies help pay some costs such as copayments, coinsurance, and deductibles that Medicare doesn't cover.

To buy a Medigap policy, you must be actively enrolled in Medicare Parts A and B (Original Medicare). Original Medicare pays Medicare-approved amounts first when you have a healthcare expense, and then the Medigap policy will pay its part.

Medigap policies generally don't cover long-term care, vision, or dental care, hearing aids, eyeglasses, or private-duty nursing. Policy coverages vary by letter, so make sure you understand the differences as part of your research.

Standardized Medigap policies are guaranteed renewable. An insurance company may not cancel your Medigap policy if you pay the premium.

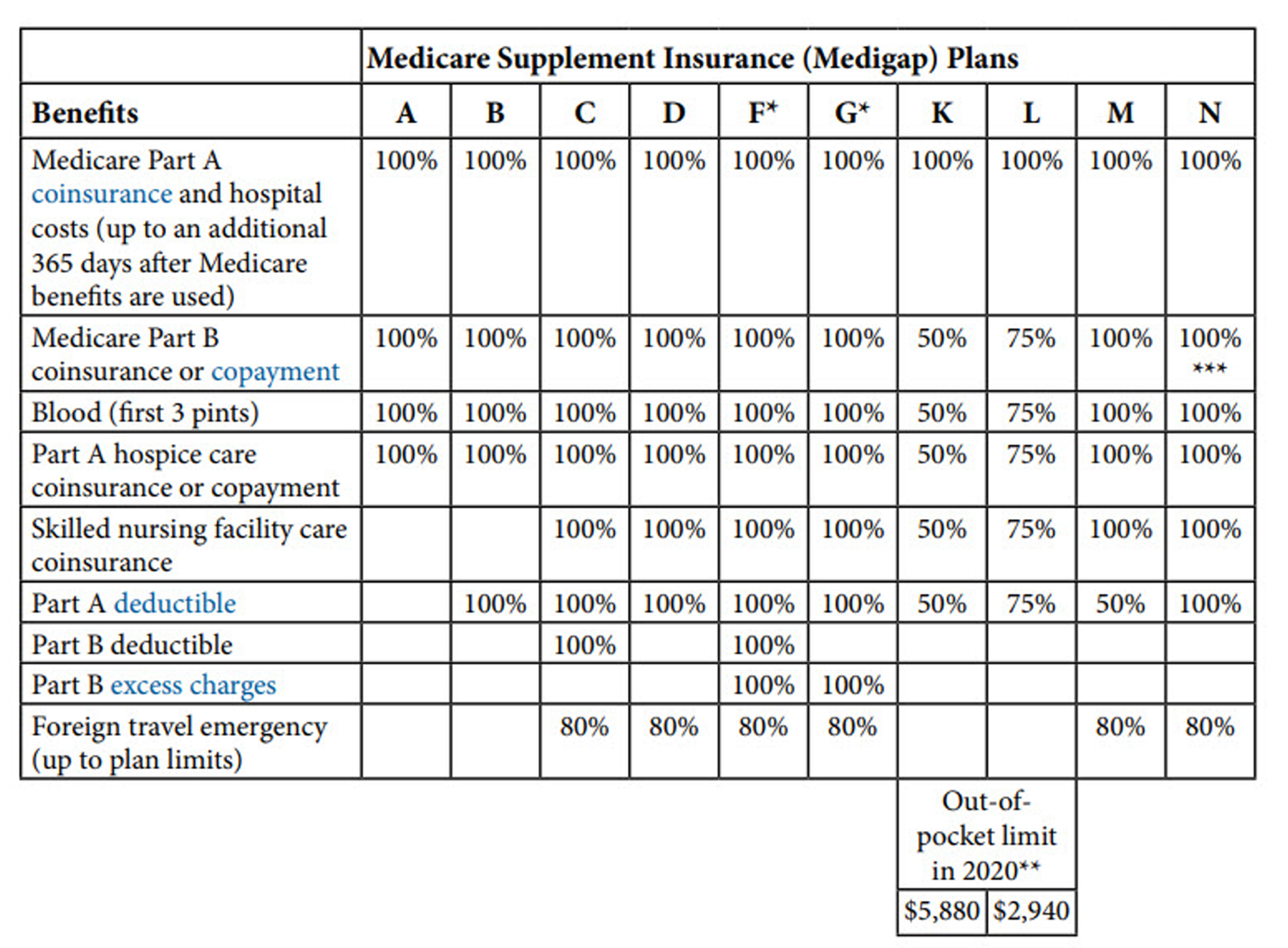

Medicare created the following chart to help you compare various policies. If a checkmark appears in a column of this chart, the Medigap policy covers 100 percent of the described benefit. If a row lists a percentage, the policy covers that percentage of the described benefit. If a row is blank, the policy doesn't cover that benefit.

Here’s what the various Medigap plans in New Jersey cover:

*Plans F and G also offer a high-deductible plan in some states. If you choose this option, you pay for Medicare-covered costs up to the deductible amount ($2,370 in 2021) before your Medigap policy pays anything. Plans C and F are not available to anyone who is newly eligible for Medicare after January 1, 2020.

**For Plans K and L, after you meet your annual out-of-pocket limit and your annual deductible, Medigap pays 100% of covered services for the rest of the year.

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in an inpatient admission.

If you have a Medicare Advantage Plan but are returning to Original Medicare only, you can apply for a Medigap policy before your Medicare Advantage Plan coverage ends. This will ensure you have continuous coverage. Your new policy should start no later than when your Medicare Advantage Plan coverage ends.

Medicare Advantage plans are run by private insurance companies and provide benefits for hospital, doctor, and other health care provider services covered under Original Medicare Parts A and B, as well as supplemental benefits that vary by plan. In some cases, depending on the benefits covered. Medicare Advantage might require you to use certain doctors and hospitals.

Medigap policies sold after January 1, 2006, do not include prescription drug coverage. You must join a Medicare Prescription Drug Plan (Part D) if you want prescription drug coverage.

Under the direction of the New Jersey Department of Banking and Insurance, the state is one of several states that have adopted rules to ensure some access to Medigap plans for enrollees under age 65. New Jersey also ensures people under age 65 don’t pay higher premiums for their Medigap coverage due to disability. This is not always the case because in many states where Medigap plans are guaranteed issue for those under 65, the premiums are still higher because insurers know that disabled enrollees are likely to incur higher costs. New Jersey’s consumer protections for disabled Medigap enrollees include provisions for those under age 50, and those age 50-64.

For Medicare beneficiaries who are under 50, coverage is guaranteed issue only with the state’s contracted carrier (Horizon Blue Cross Blue Shield of New Jersey) and the available plan is Medigap Plan D.

For Medicare beneficiaries who become eligible between 50 and 64, coverage for Plan D is guaranteed issue with any insurer in New Jersey that offers Medigap plans.

Private insurance companies sell Medigap plans. They are approved and regulated by the state of New Jersey, and all insurance companies must offer the same benefits under a given plan. However, the monthly premium you pay for that plan may differ from one company to another.

Each insurance company sets its own prices for Medigap policies, subject to the state’s approval.

Also, you have 30 days from the date you received the policy to review it. If you return the policy during this time, the insurance company must refund the premium you paid.

Prices for Medigap policies can be set in one of three ways:

expensive as you get older.

In all cases, premiums can increase each year due to inflation and other factors.

Aside from the lettered policy you decide on, several other factors can determine the amount of premium you pay.

However, Medigap policy rates can change frequently. Work with your agent to get the latest quotes. Also, current rates are posted on the New Jersey State Health Insurance Assistance Program website. To give you a general idea of costs, you can see those rates and what companies are currently offering policies here:

For planning purposes, you can factor in those rates will rise about 3-6% annually.

Everyone has a specific Medigap open enrollment period that starts on the first day of the month that you first enrolled in Medicare Part B. This open enrollment period lasts for six months.

During your open enrollment, an insurance company must offer every plan it sells and can't use medical underwriting or your medical history to refuse to sell you a policy or sell you a policy at a higher price.

Companies can't make you wait for coverage to start unless it's directly related to a pre-existing condition. If you do have a medical condition that existed within six months before you purchased your Medigap policy, this condition may not be covered during the first six months of your coverage unless you had prior creditable coverage such as group health insurance, individual health insurance, Medicare, or Medical Assistance.

You will probably get the best Medigap policy price during your open enrollment period.

There are certain times when you have the right to purchase a Medigap policy. This is known as guaranteed issue rights, and companies must sell you a policy without placing conditions on it.

There are a lot of variables to consider as detailed in the following chart:

|

You have a guaranteed issue right if... |

You have the right to buy... |

You can/must apply for a Medigap policy... |

|

You're in a Medicare Advantage Plan Your plan is leaving Medicare or stops giving care in your area You move out of the plan's service area |

Medigap Plan A, B, C, F, K, or L that's sold in your state by any insurance company You only have this right if you switch to Original Medicare rather than join another Medicare Advantage Plan. |

As early as 60 calendar days before the date your healthcare coverage will end, but no later than 63 calendar days after your healthcare coverage ends Medigap coverage can't start until your Medicare Advantage Plan coverage ends. |

|

You have Original Medicare. An employer group health plan (including retiree or COBRA coverage) Union coverage that pays after Medicare pays and that plan |

Medigap Plan A, B, C, F, K, or L that's sold in your state by any insurance company If you have COBRA coverage, you can either buy a Medigap policy right away or wait until the COBRA coverage ends. |

No later than 63 calendar days after the latest of these dates: Date the coverage ends The date on the notice you get telling you that coverage is ending (if you get one) Date on a claim denial, if |

|

• You have Original Medicare and a Medicare SELECT policy. You move out of the Medicare • SELECT policy's service area. Call the Medicare SELECT insurer for more information about your options |

Medigap Plan A, B, C, F, K, or L that's sold by any insurance company in your state or the state you're moving to |

As early as 60 calendar days before the date your Medicare SELECT coverage will end, but no later than 63 calendar days after your Medicare SELECT coverage ends. |

|

You joined a Medicare Advantage Plan or Programs of All-inclusive Care for the Elderly (PACE) when you were first eligible for Medicare Part A at 65, and within the first year of joining, you decide you want to switch to Original Medicare |

Any Medigap policy that's sold in your state by any insurance company |

As early as 60 calendar days before the date your coverage will end, but no later than 63 calendar days after your coverage ends. NOTE: Your rights may last for |

|

You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you have been in the plan less than a year, and you want to switch back |

The Medigap policy you had before you joined the Medicare Advantage Plan or Medicare SELECT policy if the same insurance company you had before still sells it If your former Medigap policy isn't available, you can buy Medigap Plan A, B, C, F, K, or L that's sold in your state by any insurance company |

As early as 60 calendar days before the date your coverage will end, but no later than 63 calendar days after your coverage ends. NOTE: Your rights may last for |

|

Your Medigap insurance company goes bankrupt, and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own |

Medigap Plan A, B, C, F, K or L that's sold in your state by any insurance company. |

No later than 63 calendar days from the date your coverage ends. |

|

You leave a Medicare Advantage Plan or drop a Medigap policy because the company hasn't followed the rules, or it misled you. |

Medigap Plan A, B, C, F, K or L that's sold in your state by any insurance company. |

No later than 63 calendar days from the date your coverage ends. |

SOURCE: Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare, Developed jointly by the Centers for Medicare & Medicaid Services (CMS) and the National Association of Insurance Commissioners (NAIC), 2012.

To buy a Medigap policy in New Jersey:

Unfortunately, Medicare and Medigap fraud and illegal activities take place all too often, so it's a good idea for you to familiarize yourself with what providers can and cannot do when selling you a policy.

The Centers for Medicare & Medicaid Services (CMS) and the National Association of Insurance Commissioners have put together the following list of things to be aware of as you shop around for a Medigap policy. It is illegal for an insurance provider to:

Choosing the right Medigap plan can be complicated, and you should do your homework before deciding on a specific plan. Talk with friends, family members, and a trusted broker/agent to get as much information as you need.

You can also get more information on Medicare's website or by accessing the New Jersey State Health Insurance Assistance Program website. You can also call 800-792-8820.

Medi-Solutions Insurance Agency, LLC is not affiliated or endorsed with the Social Security Administration or the Federal Medicare Program. Information is for educational purposes only and should not be construed as an offer of insurance, advice, or recommendation. The information provided is not intended as tax, financial, investment, or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Other articles:

Learning Center.