(800) 435-4765

Mon - Fri 9:00am - 5:00pm

Social Security is an important financial safety net that pays benefits to millions of people each year. There is a lot to know to maximize those benefits when it is time, but the best place to start is with answers to the most common questions.

It depends on which kind of benefits you seek. Social Security offers four main types of benefits:

Disability benefits (SSDI)

Benefits for spouses or other survivors of a family member who has passed away

Supplemental Security Income (SSI)

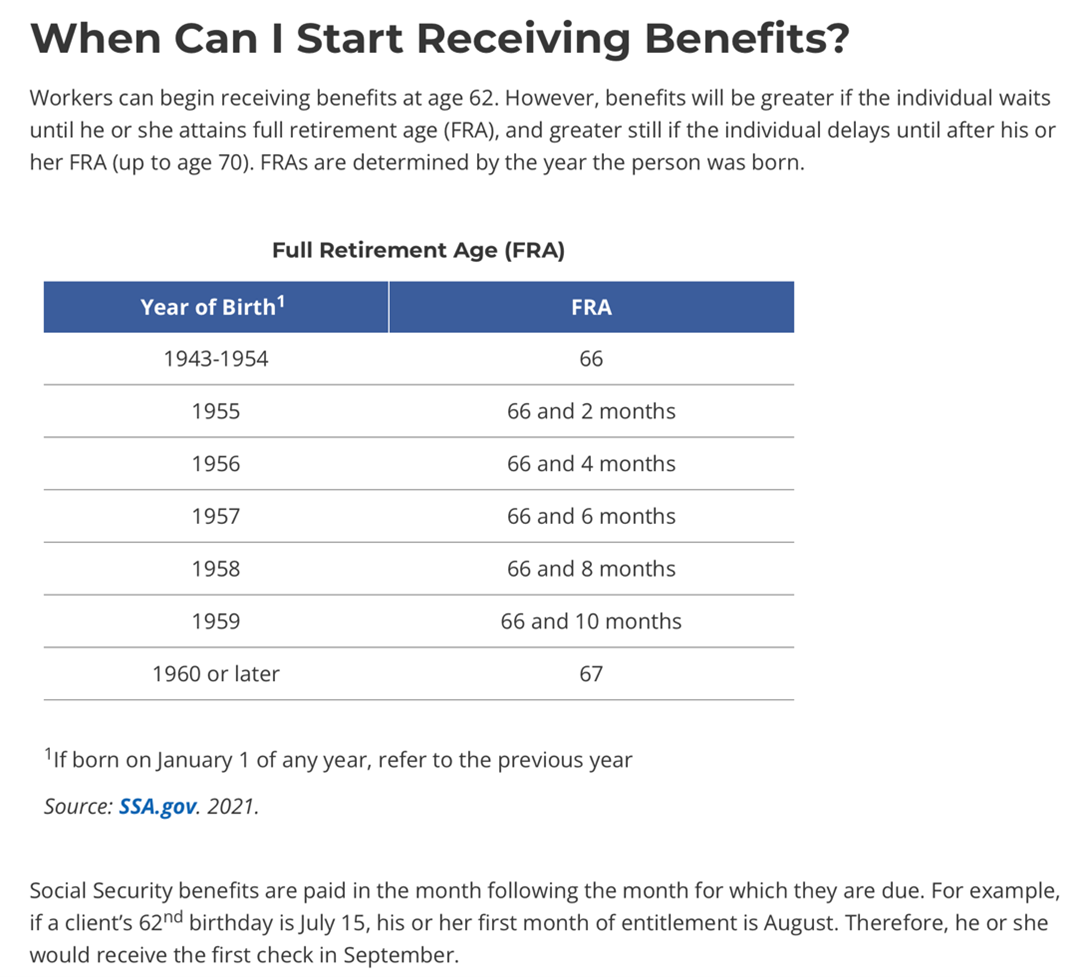

Each of these benefits has different requirements related to your age and circumstances. For example, if you are seeking retirement benefits, the earliest you can apply is at 61 years and 9 months to start drawing benefits when you turn 62. However, this may not be the best time to apply because your benefits could be reduced by as much as 30% below what you would get if you waited to begin getting benefits until your full retirement age.

You can max out your retirement benefit amount by waiting until age 70. That will increase your benefit because you earned "delayed retirement credits."

The age to claim your full Social Security benefit varies depending on your birth year. The full retirement age is 65 for those born in 1937 or earlier, 66 for baby boomers born between 1943 and 1954, and 67 for people born in 1960 or later.

Those born in 1938-1942 and 1955-1959 have an even more specific retirement age. For example, the full retirement age is 65 and 10 months for people born in 1942 and 66 and four months for boomers with birth dates in 1956.

Those who sign up for Social Security between age 62 and their full retirement age get smaller monthly payments while delaying claiming can increase your benefit until age 70.

Your benefit increases by 8% each year you delay taking Social Security from your full retirement age until age 70.

You have several options:

For retirement benefits, Social Security bases eligibility on the credits you earn during your working years. For example, as of 2022, for every $1,510 you make, you earn one credit, up to a maximum of four per year. If you were born in 1929 or later, you need to accumulate 40 credits (10 full years of work) to receive benefits when you retire.

SSDI disability benefits and SSI supplemental income benefits use different criteria. SSDI is based on whether you can continue working based on the severity and length of your disability. To qualify, you must have a disability that will last 12 months or more and keep you from doing the same type of work you have done in the past. There are several other requirements, so it is best to do a deeper dive if you think you might qualify.

To get SSI benefits, you must be 65 or older, blind, or disabled, and have limited income and resources. Again, there are other requirements, but these are the basics that you must meet

Social Security uses two formulas. The first is based on your 35 highest-earning years indexed for inflation. The second transforms that calculation into a monthly benefit.

The rule of thumb is that the more Social Security qualifying income you earn over your working lifetime, the higher your benefit. Higher earnings in the years just before retiring may also increase your benefit.

There is a limit to the annual income that qualifies for the Social Security calculation. The taxable maximum is $147,000 in 2022.1 If you earn more than the annual maximum in a given year as an employee, the income above that threshold will not be subject to the 6.2% Social Security payroll tax or 12.4% if you are self-employed.

You can get a personalized estimate of your future Social Security benefit by creating a My Social Security account and viewing your Social Security statement. Your statement lists how much you are likely to receive in retirement at various potential claiming ages between 62 and 70 if you continue working at your current salary.

You can also use the online Social Security Retirement Estimator to get a rough idea of what you will get.

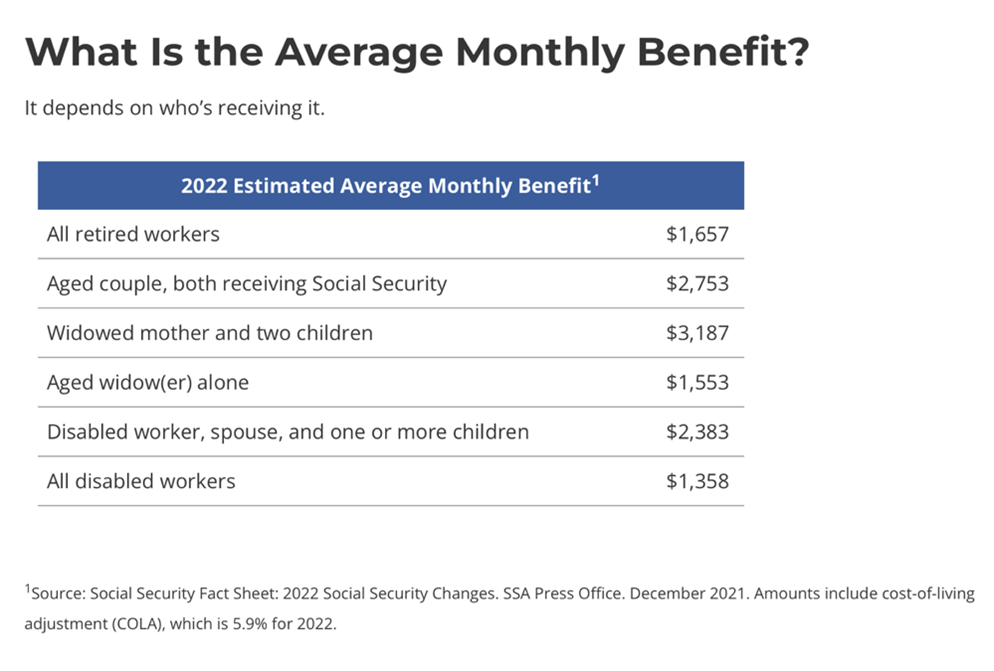

The maximum possible Social Security benefit changes depending on the age you retire. In 2022, here are some examples of what the maximum amounts are:

$2,364 at age 62

$3,345 at age 66 and 4 months

$4,194 at age 70

To qualify for these large payments, you need to maintain a high income throughout your career of 35 years or more. People who receive the maximum benefit possible have earned at or above the highest taxable wage base of all of the years used in the benefit calculation.

While you cannot do anything to revise your earnings history, there are other steps you can take.

First, work longer. If you have not hit a 35-year income history yet, every year that you work replaces a zero-income year.

Also, if you are making more money now, these lower income years are zeroed out, also adding to your benefit.

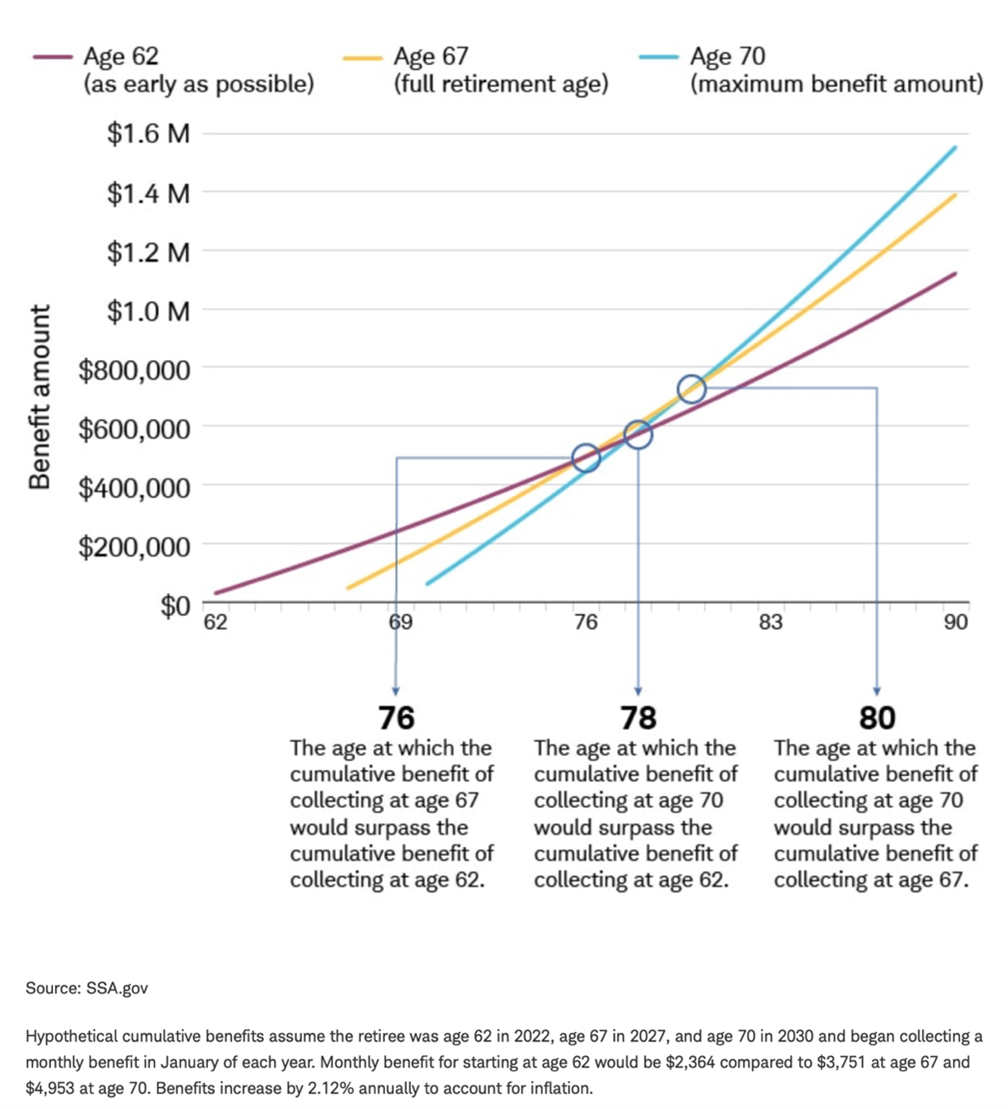

Delaying the age at which you collect your benefit also helps your bottom line benefit. Although you can start collecting Social Security as early as 62, receiving your benefits before full retirement age—between 66 and 67, depending on your birth year—will reduce your payment by between 5% and 7% each year.

Every year you delay past your full retirement age will increase your annual payout by about 8% until age 70, when the benefit increases stop. That means you will receive from 24% to 32% more than if you had begun collecting at your full retirement age and roughly 76% more than if you had started collecting at 62.

There are also some types of earnings that have additional rules. These include:

Nonprofit Or Religious Organizations

State And Local Government Employment Wages

Work Outside the United States

Pensions and taxes have the potential to impact your retirement benefit, including

This chart also helps illustrate how waiting to collect benefits can increase the amount you receive.

It depends.

Generally, couples who file a joint tax return and have a combined income from $32,000 to $44,000 will have to pay income tax on up to 50% of their benefits. If their combined income is more than $44,000, they will be taxed on up to 85% of their benefits. Even if your spouse did not receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

For single filers, income thresholds are $25,000 to $34,000 for 50% and more than $34,000 for 85%.

Combined income is defined as adjusted gross income plus any nontaxable interest and half of your Social Security benefits.

Also, Social Security benefits include monthly retirement, survivor, and disability benefits. They do not include supplemental security income (SSI) payments, which are not taxable.

The net amount of social security benefits you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement. This is also the amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

Yes, but there are some essential things to consider. If you have reached full retirement age, you can work and earn as much as possible and receive full benefits. The reduction is $1 for every $2 of earned income over $19,560 in 2022 if you are younger than full retirement age.

Your benefits will be reduced temporarily if you are under full retirement age. The money is not lost, however. Social Security will credit it to your record when you reach full retirement age, resulting in a higher benefit.

During the year when you reach full retirement age, your benefits will be reduced by $1 for every $3 in income over $51,960 in 2022. That continues until the month when you become fully eligible.

If you have a disability, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) may help financially.

Here is a brief overview of each program:

SSDI is for people who have become disabled after earning enough Social Security work credits within a specific time. You can apply for SSDI benefits online, by phone, or in person.

If your application is approved, you will have a five-month waiting period for benefits to start.

SSI is for people with disabilities or 65 or older with little to no income and resources. Although the names sound similar and the Social Security Administration runs the program, it does not fund SSI. Adults can apply for SSI by phone, in person at a local Social Security office, or in some cases, online. To apply for SSI for a child, you can start the process online but need to complete it either in person or by phone.

To determine if you are eligible for either program, use the Benefit Eligibility Screening Tool.

You must meet Social Security's strict definition of a disability for both programs. Those elements include:

Social Security uses a step-by-step process to decide if you have a disability to determine eligibility.

If you receive SSDI or SSI, you may be able to work without it impacting your benefits as long as you earn less than a certain amount.

If you have not worked or do not have enough Social Security credits to qualify for your own Social Security benefits, you may be able to receive your spouse's benefits.

To qualify, you must meet one of these conditions:

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to receive your spouse's benefits before reaching full retirement age, your benefit amount will be permanently reduced.

You will receive your full spouse's benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse's record who is younger than age 16 or disabled.

If you have enough credits to qualify for your own Social Security benefits and apply for your retirement benefits and benefits as a spouse, your benefits are paid first. If your benefits as a spouse are higher than your retirement benefits, you will get a combination of benefits equaling the higher spouse benefit.

When you are at least 62 years of age and wish to apply for retirement or spouse's benefits, you can use Social Security's online retirement application to apply for one or both benefits.

If you are divorced, and your marriage lasted at least 10 years, you may be able to get benefits on your former spouse's record.

If your spouse or ex-spouse is deceased, get more information from Social Security on their website at When A Family Member Dies.

In some cases, the answer is yes.

In addition to your spouse, dependent children and even grandchildren may be eligible to receive benefits when you die, become disabled, or retire.

To qualify, a dependent must be unmarried and meet certain age requirements:

Payments stop when:

These rules are complex, especially when it involves a disability. It is smart to consult with appropriate benefit specialists at the Social Security Administration.

DISCLAIMER: Medi-Solutions Insurance Agency, LLC is not affiliated or endorsed with the Social Security Administration or the Federal Medicare Program. Information is for educational purposes only and should not be construed as an offer of insurance, advice, or recommendation. The information provided is not intended as tax, financial, investment, or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Other articles:

Learning Center.