(800) 435-4765

Mon - Fri 9:00am - 5:00pm

If you are eligible for Medicare, you may be considering Medigap coverage and wondering how it could benefit you. In today’s blog post, we are going to discuss what a Medicare supplement plan is, how it works, the benefits, and how to know if you’re eligible. Continue reading to learn more and if you are interested in speaking to an experienced agent, it’s time to contact Medi-Solutions Insurance Agency, LLC. Our agents will work with you one-on-one to discuss your options and help you pick the right plan for you. Contact us today to get started.

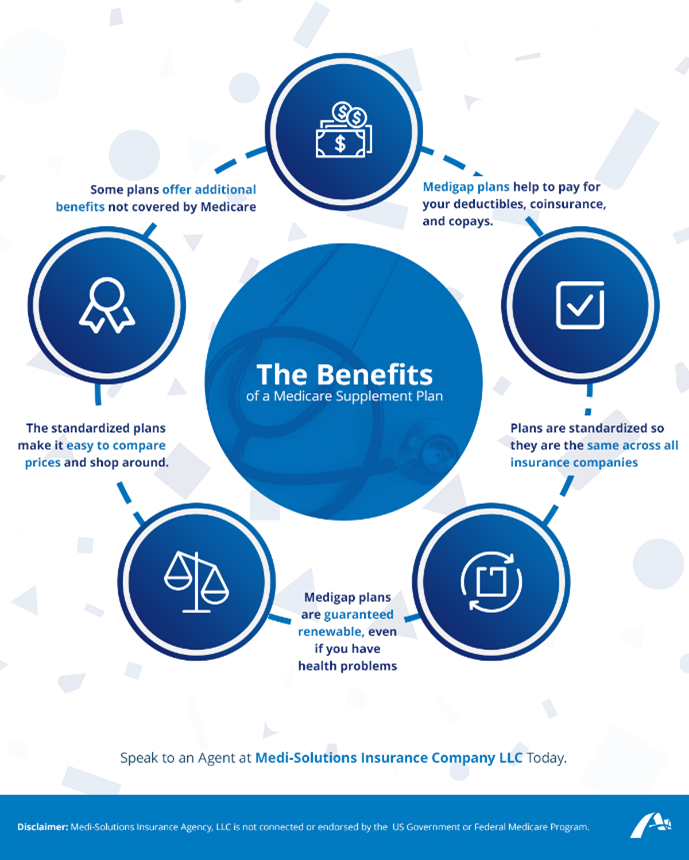

A Medicare supplement plan, also known as a Medigap plan, is a health insurance plan sold by a private company that supplements your Medicare health insurance. Medigap plans can supplement your Medicare in two ways: they help to cover the costs of deductibles, coinsurance, and copays, and secondly, they often offer additional benefits that are not covered by Medicare.

In order to be eligible for a Medigap plan, you must be signed up for both Part A (hospital insurance) and Part B (medical insurance) of Medicare. Medigap plans are regulated by both state and federal laws for your protection. This means that no matter which insurance company you choose to purchase your plan through, the plans will be the same. For example, Plan A will offer the same exact coverage whether you choose to purchase it from Insurance Company #1 or Insurance Company #2. The prices of these plans may vary depending on the company, so it is in your best interest to utilize an insurance agency with experienced agents such as Medi-Solutions Insurance Agency, LLC to help you sort through the available plans and choose the one that is right for you.

In order to be eligible for a Medigap plan, you must have Original Medicare and sign up for both Part A and Part B. You should apply for Medicare supplement insurance during your open enrollment period. If you choose to apply after your open enrollment period is over, the private insurance companies are typically allowed to use medical underwriting to charge higher prices and decide your eligibility.

Plans available to you will depend on which state you live in and there are some other laws and regulations that govern Medigap insurance and eligibility that may apply on a case-by-case basis. The best way to understand your eligibility and which plans are available to you is to speak to an experienced insurance agent that specializes in handling Medicare and Medigap policies. When you contact Medi-Solutions Insurance Agency, LLC, we’ll provide you with all of the information you need to make an informed decision. Contact us to get started today.

Information is for educational purposes only and should not be construed as an offer of insurance, advice, or recommendation. The information provided is not intended as tax, financial, investment or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Not connected or endorsed by the US Govt or the Federal Medicare Program. Medi-Solutions Insurance Agency, LLC is an independent Life, Accident and Health Insurance Agency, NJ Ref#1642311. Some plans and features may not be available in all states.

Other articles:

Learning Center.