(800) 435-4765

Mon - Fri 9:00am - 5:00pm

At Medi-Solutions Insurance Agency, LLC, we understand how important it is for you to have quality health insurance, and how essential it is that you have a thorough understanding of your options. We are to help you understand Medicare, Medicare Advantage plans, and Medigap plans so that you can choose the plan that is right for you. Continue reading to learn more about Medicare, and when you are ready to speak with a patient, knowledgeable agent, contact Medi-Solutions Insurance Agency, LLC today.

Medicare is a federal health insurance program designed to provide medical insurance to people who are 65 years of age and older as well as some people with disabilities. If you are eligible for Medicare, you can sign up for Original Medicare or a Medicare Advantage plan. You also have the option to add a Medicare Supplement Plan (sometimes called a Medigap plan) to cover additional costs like coinsurance, copayments, and deductibles. Medigap plans also often offer additional coverage that Medicare plans do not.

Those who are eligible for Medicare must fall into one of the following categories:

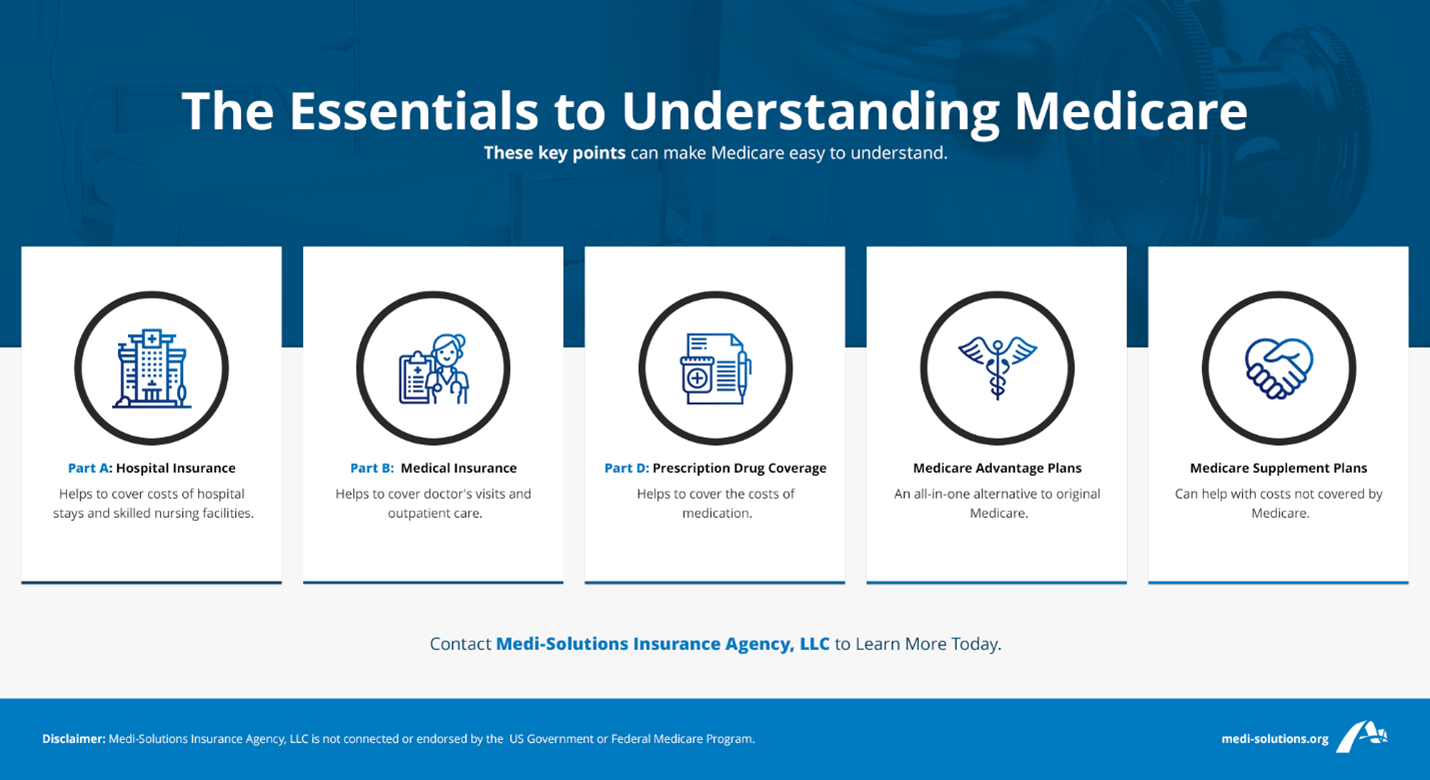

Medicare is made up of three parts: A, B, and D. While you may often hear about a Part C, this is actually referring to Medicare Advantage plans, which we will discuss a little later on.

Part A is hospital insurance. This part of the plan helps to cover the costs associated with hospital stays, hospice care, some part-time home health care, and confinement to a skilled nursing facility. The premium for this part of Medicare is usually paid for by the taxes that were previously taken out of your paycheck, so many people do not need to pay a monthly premium.

Medicare Part B is medical insurance. This part of Medicare helps to cover costs associated with doctor’s visits, outpatient care, tests, and supplies. Medicare Part B requires you to pay a monthly premium, which, many times, is automatically deducted from your social security benefit.

Part D of Medicare is prescription drug coverage. This is an optional plan that you can add on to your Medicare coverage either through Original Medicare or by choosing a Medicare Advantage plan that offers prescription drug coverage.

When it comes to signing up for Medicare, you do have options. You can choose to sign up for Original Medicare or an all-in-one Medicare Advantage plan. You can also choose to supplement your Medicare coverage with a Medigap plan. Continue reading to learn more about your Medicare options.

Original Medicare includes both Part A and Part B. You pay for services as you receive them until you meet your deductible and then you’ll be required to pay a coinsurance, which is typically 20% of the cost of the service.

Medicare Advantage plans, sometimes called Part C of Medicare, are offered by private companies that have been approved by Medicare. They are all-in-one plans that include Part A, Part B, as well as other coverage options. You can choose a Medicare Advantage plan that includes Part D, vision, dental, hearing, and other health insurance options. Medicare pays these companies a fixed amount each month for your care. The costs associated with Medicare Advantage plans can vary from company to company.

Medicare supplement plans, also known as Medigap plans, are health plans that cover some of the costs not covered by Medicare such as deductibles, coinsurance, and copays, and can also offer additional coverage such as foreign travel emergency health coverage. The Medicare Access and CHIP Reauthorization Act (MACRA) is a law that changed Medicare Supplement plans in all states and became effective on January 1, 2020. This law affected who can buy Medigap Plans F, High F, and C. As of 2020, only beneficiaries that are not newly eligible are able to keep Plan F, High F and C. Learn more about Medigap coverage and the plans available in your area from Medi-Soutions Insurance Agency, LLC.

At Medi-Solutions Insurance Agency, LLC, our caring and knowledgeable agents take the time to get to know each and every one of our patients. We then make plan recommendations based on your lifestyle, situation, and needs. When you work with Medi-Solutions Insurance Agency, LLC, you can rest assured that we will provide you with everything you need to understand Medicare, Medigap coverage, and how to make the decision that is right for you. Contact our team today.

Information is for educational purposes only and should not be construed as an offer of insurance, advice, or recommendation. The information provided is not intended as tax, financial, investment or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Not connected or endorsed by the US Govt or the Federal Medicare Program. Medi-Solutions Insurance Agency, LLC is an independent Life, Accident and Health Insurance Agency, NJ Ref#1642311. Some plans and features may not be available in all states.

Other articles:

Learning Center.